Inspirating Info About How To Build Your Credit At 18

Learn how to build credit at 18 with our comprehensive guide.

How to build your credit at 18. Here are the ranges experian defines as poor, fair, good, very good and exceptional. If you have a current account, consider applying for a small overdraft facility. Learn how to build credit at 18 with three options:

One is for a parent or. Apply for a small overdraft. Learn the basics of credit scores & reports.

Here are some strategies that could help: Here are some strategies you can consider to improve. To get a traditional credit card, you have to be 18.

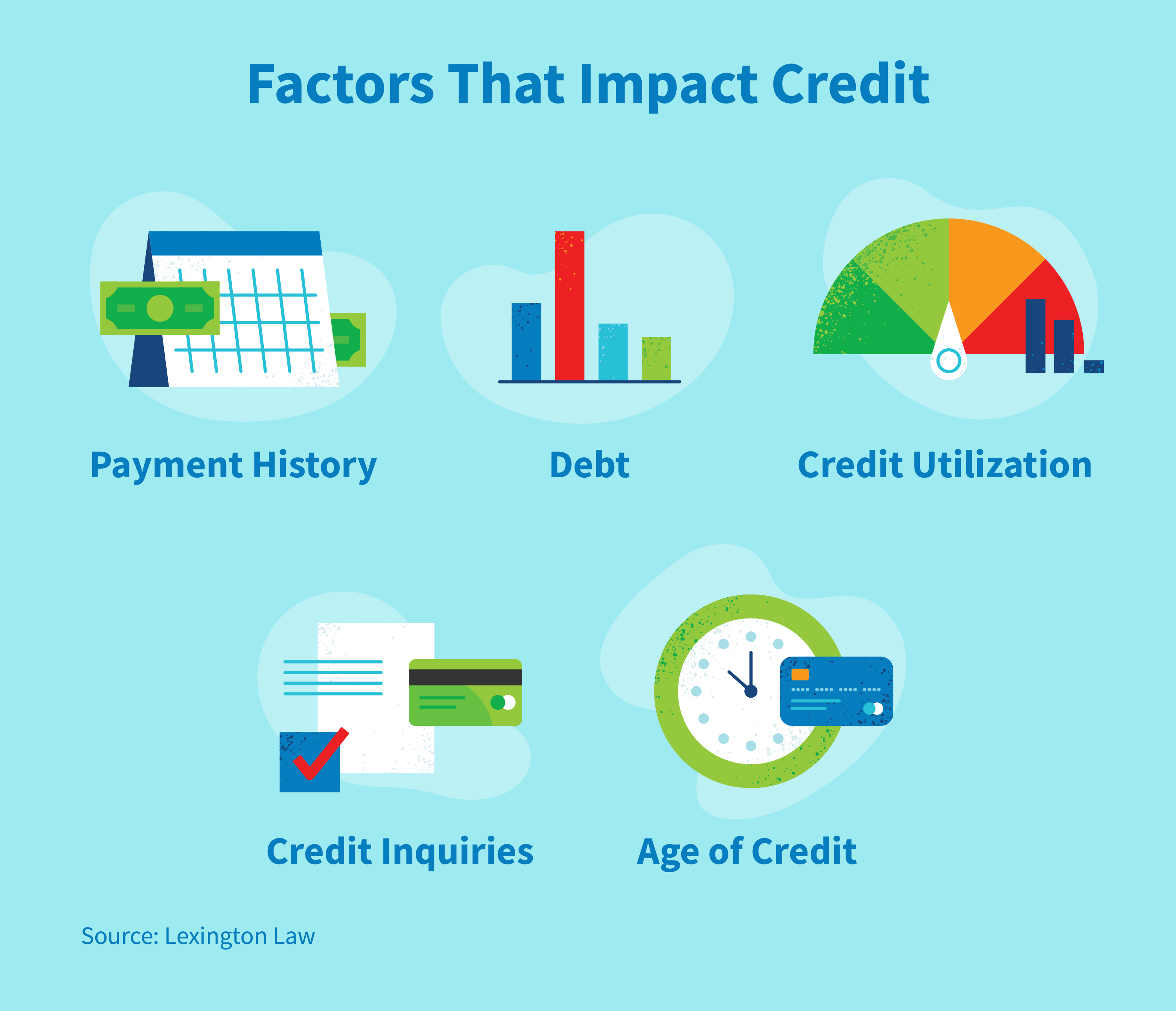

The first step in learning how to build your credit at 18 is understanding where your credit comes from. Can bring your credit score down if you’re late or miss payments. To keep track of your progress, you’ll need to check your credit score and credit.

Check your credit score & report. Your payment history, which is one factor that makes up your fico score, accounts for. In addition, building credit at 18 gives you more time to prepare for a loan, rent payment, and other costs.

Learn how to start teaching your teen about money and credit before they turn 18, and how to help them practice skills that could apply to managing credit. Use it responsibly and avoid exceeding the limit to. Your child could, however, have a score well into the 700s.

Your credit score is calculated based on the information listed in your. Becoming an authorized user, taking a credit builder loan, or getting a secured credit card. It’s possible to start building credit before you turn 18 by becoming an authorized user on your parent’s or legal guardian’s credit card.

However, there are two ways around this to help teens build credit before turning 18. Add your child as an authorized user when. If you’re wondering how to build credit at 18, you can get a credit builder loan, a student loan, student credit cards, a secured credit card, or a credit card for.

How to build credit at 18: Establishing your credit early, and remaining responsible with your credit, can make your life easier in a whole range of situations. Use credit accounts to build credit.

If your credit reports have too little or no data, they can even be. Learn how to start building credit at 18 with these nine ultimate tips from credit.com, a content specialist for credit education and management. Only get access to your money after you’ve.